Homeowners Insurance in and around Savage

Savage, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

One of the most important precautions you can take for your family is to get homeowners insurance through State Farm. This way you can unwind knowing that your home is covered.

Savage, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

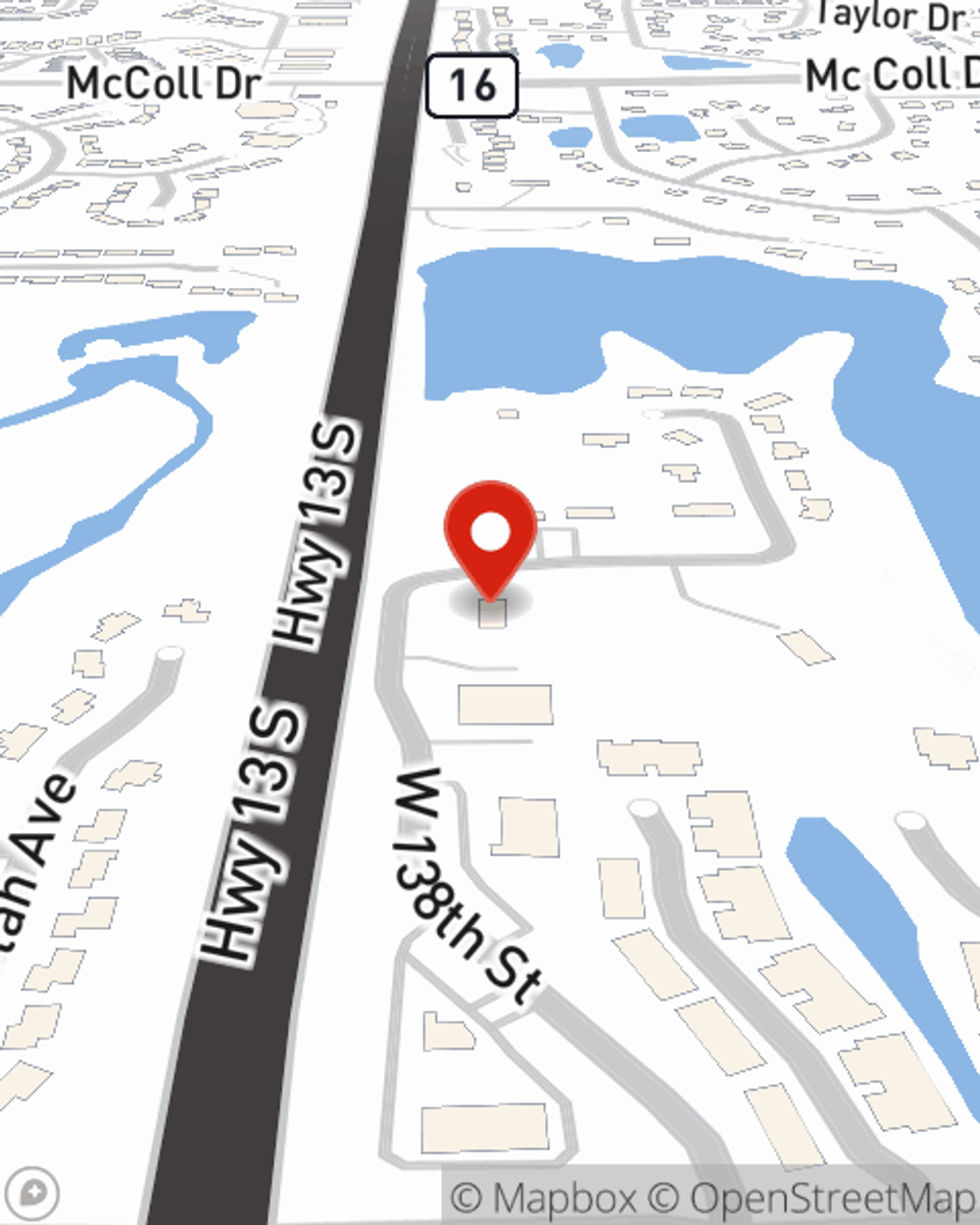

Agent Joe O'connor, At Your Service

From your home to your precious pictures, State Farm is here to make sure your valuables are covered. Joe O'Connor would love to help you know what insurance fits your needs.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unforeseen hailstorm damage to your property. Contact Joe O'Connor today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Joe at (952) 226-1500 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do when your basement floods

What to do when your basement floods

Basement flooding isn't time for you to panic. Use these steps to figure who to call when a basement floods and what to do to protect your belongings and your home.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Joe O'Connor

State Farm® Insurance AgentSimple Insights®

What to do when your basement floods

What to do when your basement floods

Basement flooding isn't time for you to panic. Use these steps to figure who to call when a basement floods and what to do to protect your belongings and your home.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.